For Customers Everywhere, innovative payment solutions and options are just what they want

Payments play an important role in the customers’ experience. When it comes to check-out, giving options and making it simple to pay may sound obvious, but on a global scale, looking for solutions that benefit the experience of customers everywhere may not be as simple as that.

The checkout process stands as a pivotal moment in the journey. While offering diverse and straightforward payment options might seem like a fundamental principle, the reality of catering to a global customer base presents a far more intricate challenge.

The quest for payment solutions that truly benefit customers everywhere demands innovation, adaptability, and a deep understanding of diverse financial landscapes.

We have long realised that customers want to have the ability to purchase using digital currency with confidence, and we want to offer them efficient and stable methods. That’s where our partnership with Triple-A has proven to be so relevant. With a seamless payment gateway integration, we already offer the option to pay in digital currency in several countries.

Worldwide, customers are increasingly adopting digital currencies, particularly in markets underbanked, lacking access to traditional financial services and where digital currencies can lower barriers, offering more accessible and easy-to-use financial tools. In these regions, digital currencies offer a compelling alternative, lowering the barriers to financial participation and providing accessible, user-friendly tools for managing funds.

The reliance on often inefficient, costly, and less secure cash-based transactions can be significantly reduced through the adoption of digital payment methods, fostering greater economic inclusion and efficiency within these markets.

Payments suited for high spenders

Beyond accessibility, digital currencies also present compelling advantages for specific customer segments, notably high-value shoppers. A recent report from our partner Triple-A provides insightful data on this trend, indicating that "Cryptocurrency customers are larger spenders, with the Average Order Value (AOV) of crypto transactions averaging 30% higher than traditional payments." This data point underscores a crucial understanding: as the value of a customer's basket increases, so too do the potential transaction fees associated with traditional banking methods, particularly for large transfers or international payments.

For high-spending individuals who frequently engage in significant purchases, the allure of digital currencies lies in their potential to offer tangible savings and greater control over their funds. The direct and often lower fee structure associated with cryptocurrency transactions can be particularly attractive when compared to the escalating costs of traditional banking for substantial sums. By embracing digital currencies, these customers can potentially unlock a more efficient and cost-effective way to manage their spend, utilising their full range of financial resources with greater ease and directness.

Farfetch remains committed to staying at the forefront of payment innovation. As part of our partnership with Triple-A we continue to empower our customers with the options they desire, ensuring a seamless, secure, and ultimately satisfying luxury shopping experience, regardless of their location or preferred method of payment. By embracing the transformative power of digital currencies and other innovative payment technologies, we are not just facilitating transactions; we are building stronger connections with our global community and shaping the future of luxury commerce.

Seamless usage

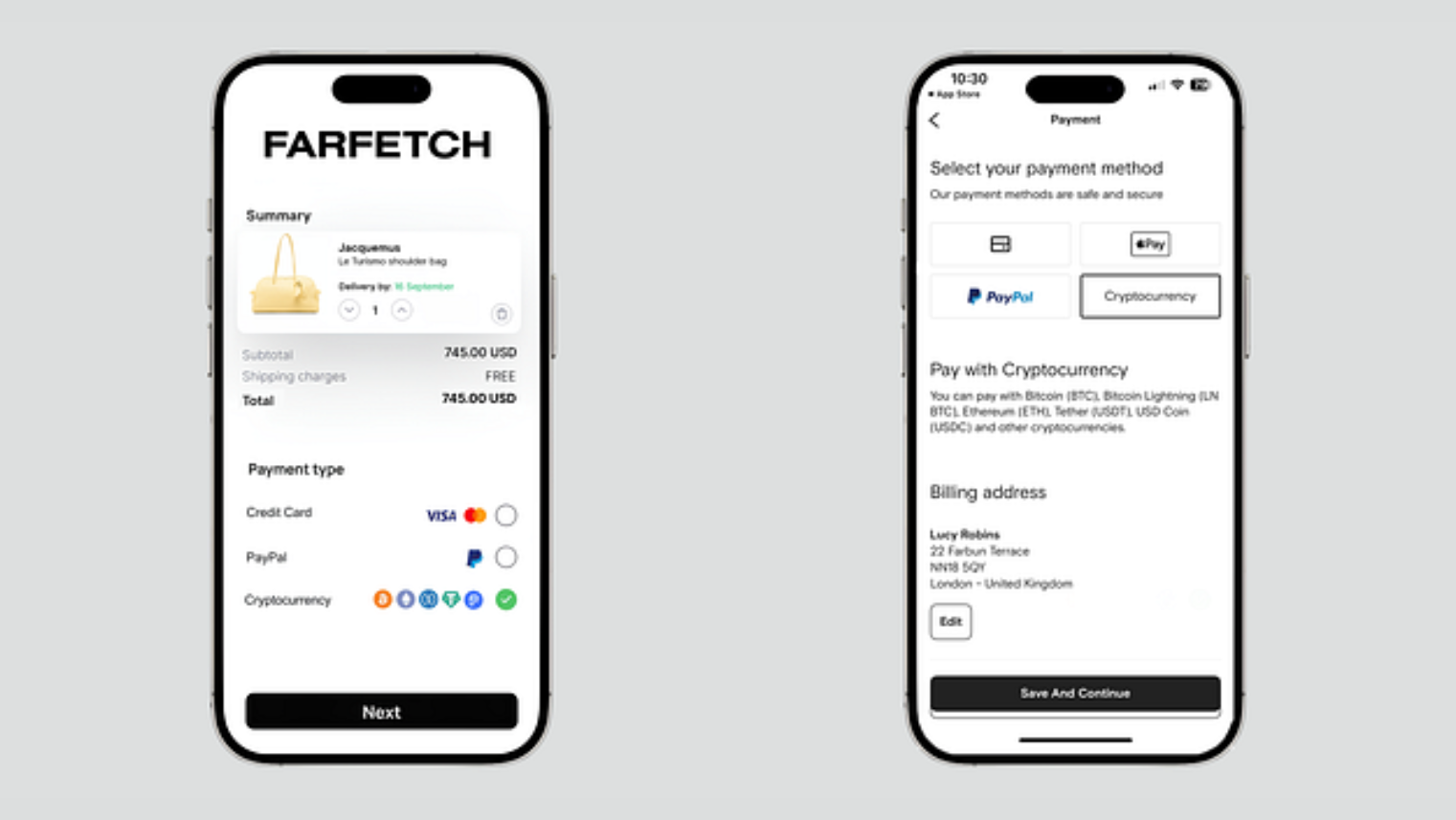

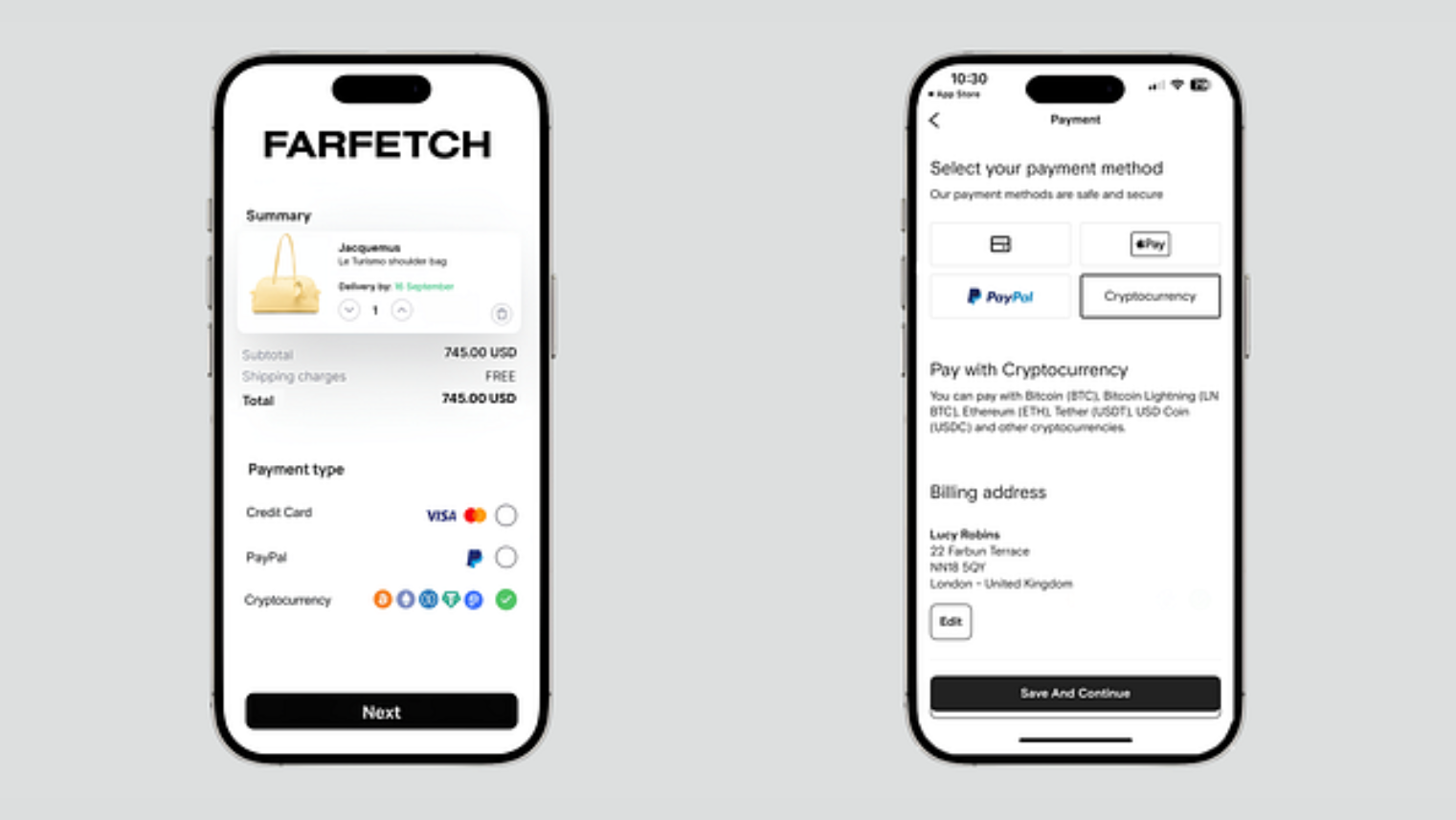

To add pictures of the checkout process using digital currency.

Figure: Illustration of checkout process using digital currency.